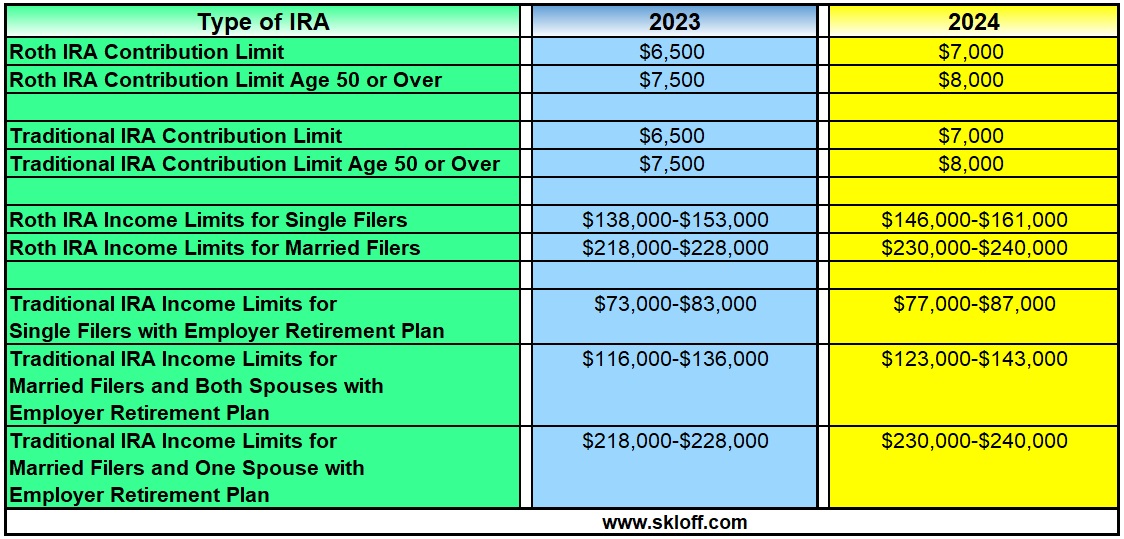

Max Amount For Ira 2024. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. Find out if you can contribute and if you make too much money for a tax deduction.

That’s up from the 2023 limit of $15,500. Learn how ira income limits vary based on which type of ira you have.

Like Both Of These Plans, The Simple Ira Is Subject To Annual Contribution Limits.

2024 simple ira contribution limits.

To Max Out Your Roth Ira Contribution In 2024, Your Income Must Be:

The ira contribution limit is $7,000 in 2024 ($8,000 if age 50.

The Pretax And Roth Employee Contributions Max Is $23,000;

Images References :

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2023 and 2024 Skloff Financial, The 2024 maximum ira contribution limit will be $7,000 an increase of $500 over the 2023 maximum ira contribution limit (which was also an increase of $500 over the prior year). The 2024 simple ira contribution limit for employees is $16,000.

Source: blockbitbank.com

Source: blockbitbank.com

IRA Contribution Limits And Limits For 2023 And 2024 BlockBitBank, If you have roth iras,. For 2023, the total contributions you make each year to all of your.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, This is an increase from 2023, when the limits were $6,500 and $7,500,. Learn how ira income limits vary based on which type of ira you have.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

Must Know 2023 Roth Ira Limits Article 2023 BGH, Learn how ira income limits vary based on which type of ira you have. For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

21+ Hsa Contribution Limit 2023 Article 2023 BGH, For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023. The maximum total annual contribution for all your iras combined is:

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, The pretax and roth employee contributions max is $23,000; Workers age 50 or older can.

Source: neelishroman.blogspot.com

Source: neelishroman.blogspot.com

Ira growth calculator NeelishRoman, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

Source: jerrilynwlian.pages.dev

Source: jerrilynwlian.pages.dev

2024 Roth Contribution Max Agata Ariella, The maximum amount you can contribute to all traditional iras and roth iras is $6,500, or. The 2024 maximum ira contribution limit will be $7,000 an increase of $500 over the 2023 maximum ira contribution limit (which was also an increase of $500 over the prior year).

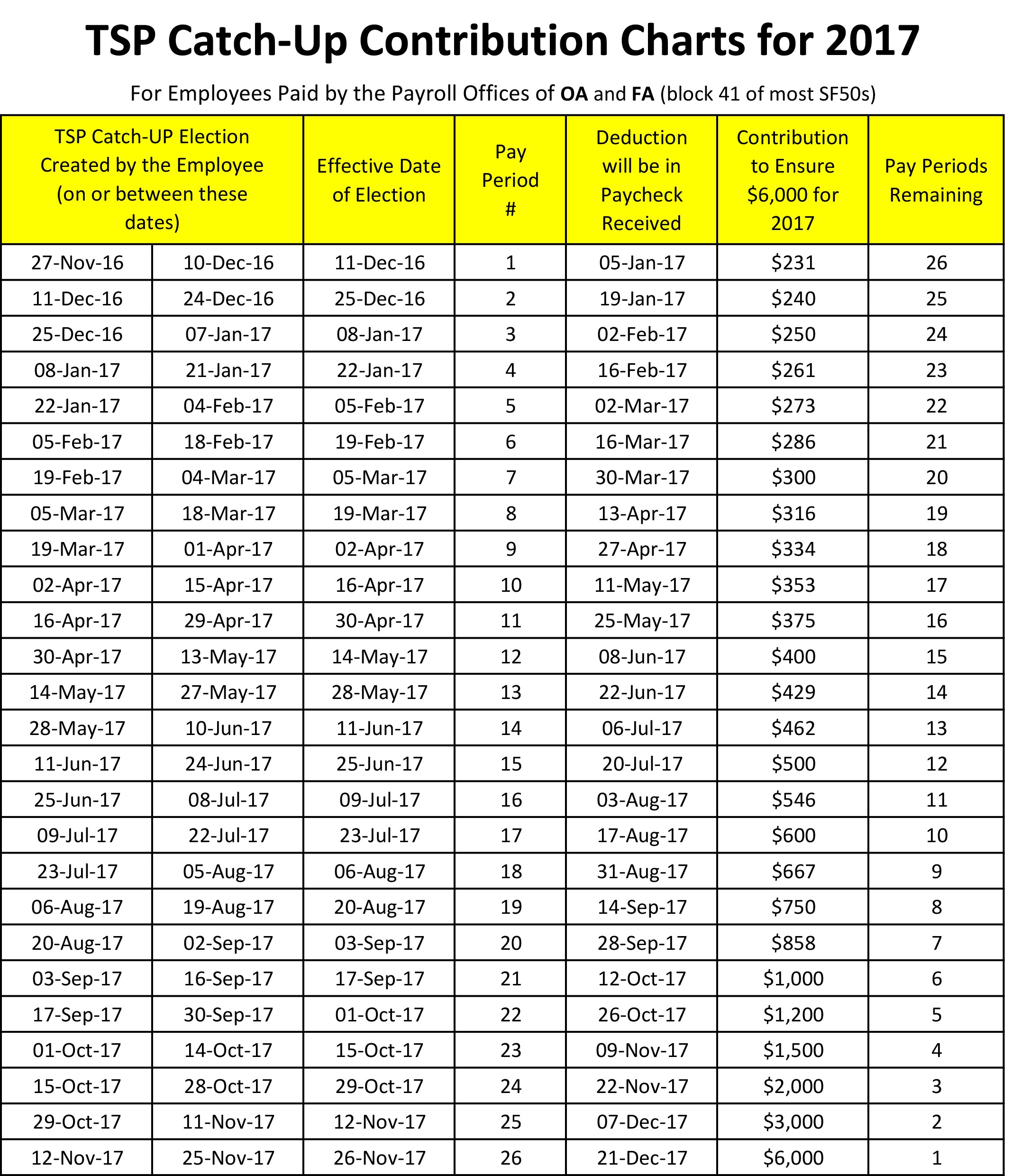

Source: admin.itprice.com

Source: admin.itprice.com

2023 Tsp Maximum Contribution 2023 Calendar, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024. For 2023, the total contributions you make each year to all of your.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, This is an increase from 2023, when the limits were $6,500 and $7,500,. Workers age 50 or older can.

For 2023, The Total Contributions You Make Each Year To All Of Your.

The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024.

What Is The Limit For Roth Ira Contributions In 2023 And 2024?

2024 simple ira contribution limits.